Caring, dependable financial planning in East Sussex

You’re in safe hands with our experienced team. From our base in Glynde, we’ve been providing reassurance and stability to clients across the region for more than 25 years.

Why usAbout you

Get the answers to any burning questions about your financial future with the help of our experts. Whatever stage of life you’re at, you’ll get support from qualified advisers who are truly invested in your happiness and success.

Learn how we can help

Our latest survey results…

would recommend us to their friends, family or colleagues

of clients believe that working with us has helped or will help them achieve their financial goals

of clients were satisfied that we understood their needs, goals, aspirations and objectives

of clients were satisfied with the speed of response from their planner

Your journey

Financial planning can transform your life, but that doesn’t mean it needs to be complicated. As our client, you’ll follow a straightforward five-step process designed to deliver the results that are right for you.

Start here

-

Exploration

In your first meeting with your adviser, you’ll explore the issues you face and your goals for the future, both financial and personal.

-

Discovery

Once you’ve told us about your circumstances, we’ll use our expertise to discover more about your finances and existing arrangements.

-

Planning

In stage three of the process, you’ll get a full financial plan that’s tailored to your requirements with our expert recommendations.

-

Implementation

If you’re happy with some or all of the recommendations made in your financial plan, we can implement them on your behalf.

-

Ongoing support

Your plan is designed for long-term prosperity, not quick wins, and we’ll be by your side throughout to offer our continuing support.

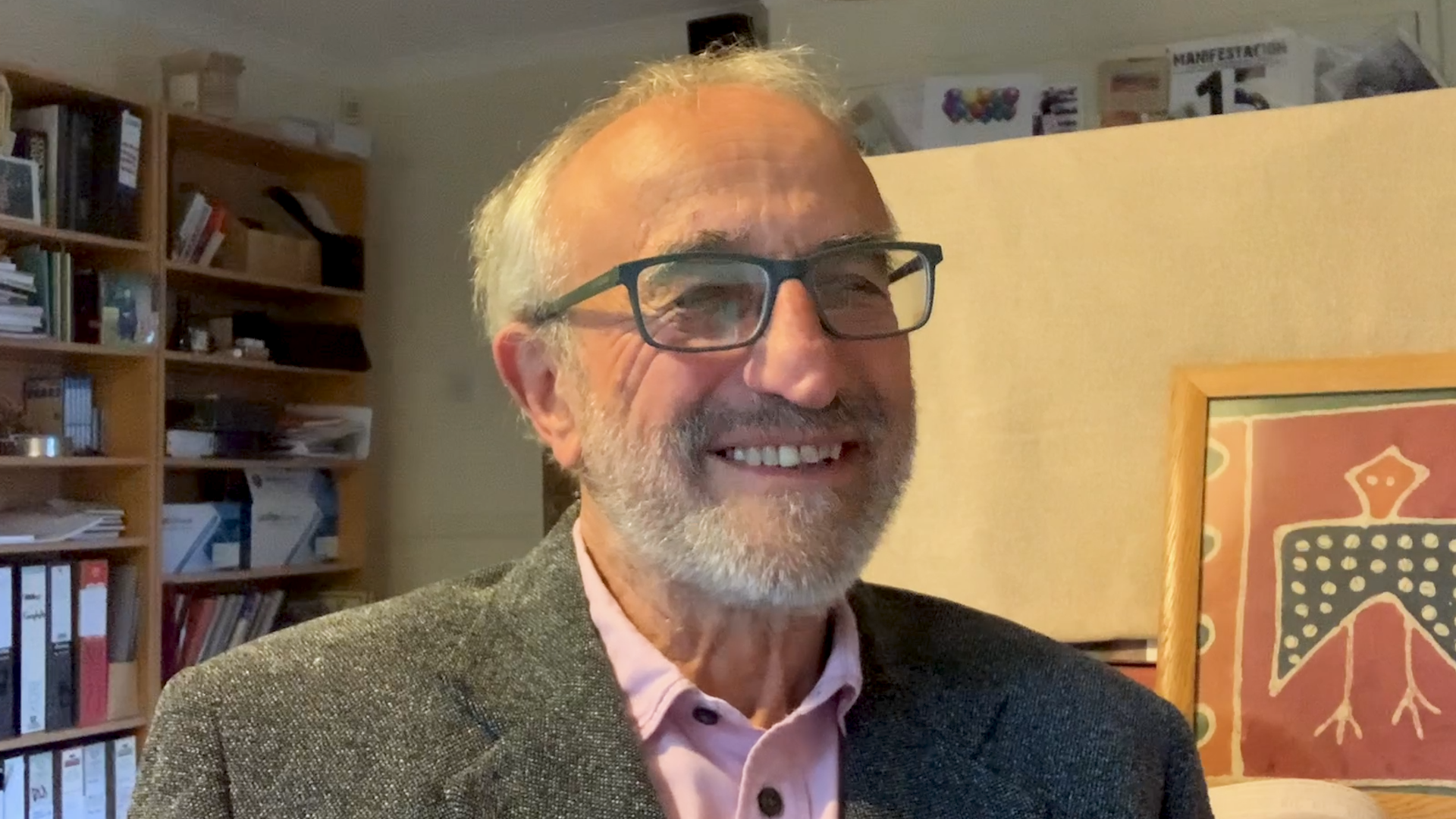

Our team

Whatever expertise you require, you’ll find it among our experienced team. From financial specialists to support staff, you’re assured of a friendly, efficient service at every stage of your journey with us.

View all

How we charge

It’s natural to feel uncertain about some aspects of taking financial advice, but with our transparent approach, fees won’t be one of them. Learn about our structured approach to pricing, what’s included in the fees you pay, and why proper financial planning can be so beneficial.

Take me there

See our fees in full...

About us

Becoming a Barwells Wealth client feels like joining a family, and in many ways, it is. With two generations at the helm, we’re proud of our long-established position in our community, which is reflected in the commitment we show to clients old and new.

Read further

Get to know us

Blog

It’s our mission to always leave you in a better-informed position than you were when you came to us. That’s why you’ll find lots of useful information and helpful tips in our regularly updated blog posts.

Get the latest updates

Production

Production