After a rocky start to the year, global markets rounded off 2025 with standout performances across the board.

The first few months saw periods of significant volatility, initially driven by developments in the AI market and then by the introduction of US trade tariffs.

However, despite considerable fluctuations, markets were quick to recover and delivered some of the strongest annual returns of the decade by the end of the year.

Indeed, 2025 was a perfect example of how short-term movements aren’t indicative of long-term trends and why it’s typically not a good idea to allow your plan to be derailed by the latest noise or headlines.

Read on to find out what last year’s market performance can teach you about the fundamentals of long-term investing.

AI developments and “Liberation Day” tariffs caused dips in the first half of the year

Markets got off to a tricky start to the year, as the release of the Chinese AI programme DeepSeek led to a mass sell-off in the US.

CNBC reports that the US chipmaker Nvidia dipped by 17% in a single day, resulting in a market cap loss of close to $600 billion and marking the biggest one-day loss in US history. This then led to the Nasdaq index experiencing its largest one-day decline since December 2018, according to Reuters.

And the difficulties didn’t end there. On 2 April, Donald Trump introduced his “Liberation Day” tariffs.

Global markets were sent into a frenzy, and both the FTSE All-Share in the UK and the US S&P 500 fell by over 12% from the start of the year.

Put simply, the first few months of 2025 were challenging for markets, and the drop-offs were some of the steepest seen in several years.

Annual market returns were among the strongest of the decade

Despite the difficult start to the year, it didn’t take long for markets to recover. By the end of May, both the FTSE All-Share and the S&P 500 had fully recovered, and both reached new all-time highs by June.

Not only did markets quickly recover the losses experienced in the first part of the year, but they also delivered some of the strongest returns in recent years.

According to JP Morgan’s annual review, markets in developed economies fell by around 16.5% after “Liberation Day” but went on to deliver returns of 21.6% by the end of the year.

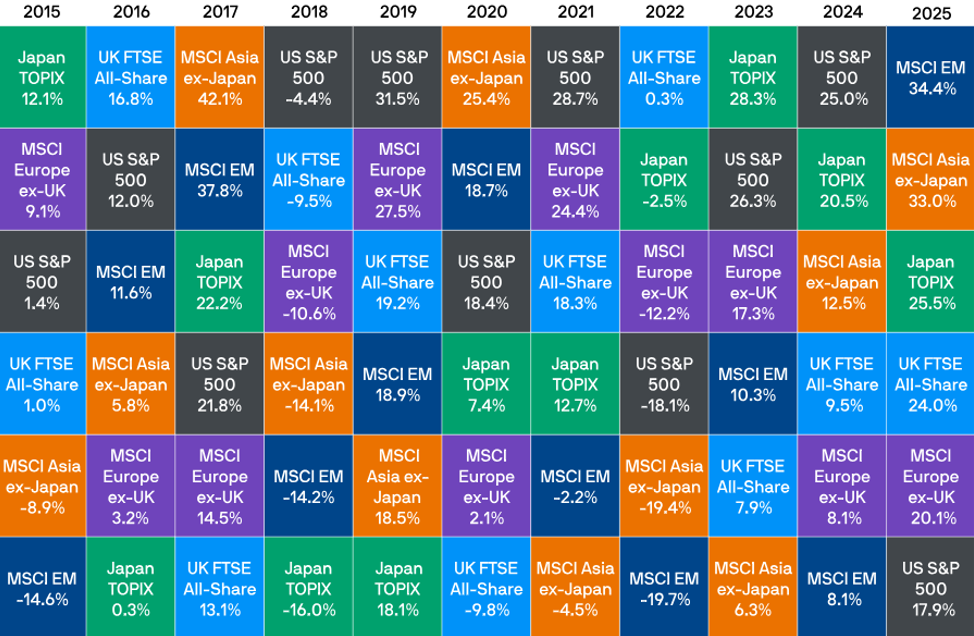

The table below shows the performance of several key global indices over the last 10 years.

Source: JP Morgan

The MSCI Emerging Markets index delivered the highest returns in 2025. Indeed, it had the highest return of any index of the decade, excluding 2017.

Meanwhile, the US S&P 500 had the lowest returns of last year but still marked the strongest return for a bottom-ranked index this decade, aside from the TOPIX in 2019.

In the UK, the FTSE All-Share finished with its highest return of the decade, up 24%.

So, after a tumultuous start to the year, 2025 capped off some of the best market performance seen in recent years.

Last year’s market performance speaks to the fundamentals of long-term investing

2025 was a good reminder of how patience and resilience are often rewarded when investing. While market fluctuations can be alarming, they are part and parcel of the journey towards long-term growth.

For instance, research by Schroders found that world stock markets experienced 10% falls in 30 of the 52 years between 1972 and 2022, meaning significant falls are more common than not.

However, as 2025 showed, investors who exited the market amid the early fall risked turning temporary declines into permanent losses. Meanwhile, those who remained invested saw markets recover relatively quickly and went on to enjoy some of the strongest returns in recent years.

Indeed, the Schroders report also found that exiting the market during every big fall since the late 19th century would have meant a longer recovery time than if you’d remained invested.

So, while you may be tempted to sell off during a downturn, historical market trends suggest that remaining disciplined and patient is typically better for long-term growth.

Financial planning can give you the confidence you need to remain resilient during downturns

Maintaining discipline and composure during significant market downturns is easier said than done.

Seeing your wealth decline before your eyes and not moving to cut your losses may seem counterintuitive, but as you’ve seen, long-term trends highlight the value of remaining resilient – and this is where a financial planner can help.

A financial planner can provide critical insights during difficult moments based on their years of experience, which can help you understand any dips (however big) in the context of historical trends.

They can also work with you to diversify your portfolio based on your risk tolerance, which can help smooth out fluctuations on your investment journey.

While the markets have got off to a solid start in 2026, there may be turbulence to come, and no one can accurately predict how markets will perform in a given year.

However, your long-term goals are likely to remain broadly consistent. So, building a diversified plan around these goals can help ensure you are better placed to manage whatever lies ahead and to capture the long-term growth of the market.

Get in touch

Our team of independent financial advisers in Lewes is here to support you in building a portfolio based on your goals that is resilient to short-term movements.

To find out more, please get in touch by emailing us at financial@barwells-wealth.co.uk or by phone on 01273 086 311.

Please note

This article is for general information only and does not constitute advice. The information is aimed at individuals only.

All information is correct at the time of writing and is subject to change in the future.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Production

Production