This month, beautiful Hever Castle hosted the Festival of Endurance as part of the popular Castle Race series. Competitors took part in a range of endurance events such as an ultramarathon, triathlon, and aquathon.

The festival celebrates everything that can be achieved with hard work and determination. In fact, the sports contain a lot of helpful lessons that can be applied to investing.

Read on to discover what you could learn about investing from long-distance endurance sports.

1. Identify your end goal

For almost any task you might undertake, having an idea of the destination is vital if you’re going to plot a route that takes you there. It’s the same for your sporting event and your investment strategy.

For the former, what is your target for the race? Perhaps you simply want to be able to make it to the finish line, or maybe you’re hoping to achieve a “personal best”.

You should also take the time to decide what you want to achieve from your investments. Whether it’s a nest egg to support you through retirement, pay for your children’s education, or go on your dream holiday, be specific about what this investment will be paying for before you start.

2. You need to prepare if you’re to achieve your goal

For those who took part in the events at Hever Castle, the day of the race was the culmination of months of hard work, training, and determination.

When you’re planning to start investing, preparation is equally as important. For example, do you have a sufficient emergency fund to draw on for unexpected expenses? This can help you to avoid investing any money you might need access to in the short term.

Another part of the preparation for a race is creating a strategy that will enable you to achieve your goal. Strategy is just as important in investing, as you will need to build a portfolio that offers you the potential to achieve your goals in the required time frame, balanced carefully according to your attitude to risk and your capacity for loss.

Without taking the time to create this strategy, you could be more likely to find yourself with a shortfall in the years to come.

3. You need to manage your emotions carefully

When you’re taking part in an endurance race, your physical fitness is just one piece of the puzzle; you also need to have the psychological strength to keep going, even when you encounter challenges.

Similarly, investors can come up against all sorts of scenarios that test their resolve, such as market volatility or an unexpected change in circumstances. In the worst-case scenario, it can lead you to make snap decisions about how your wealth is invested.

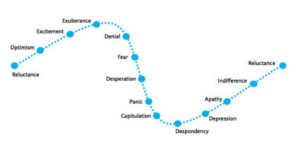

The diagram below shows how the performance of your investments can stir up emotions that make it tricky to make sensible financial decisions:

Source: Barclays

If you allowed your emotions to guide your decisions, you’d likely end up buying investments at higher prices, as surging values make you feel excited about the opportunity to grow your wealth.

You might also end up selling investments at the lowest price point in the cycle when you’re feeling more dejected or even panicked. This could dramatically reduce the potential you have to generate positive returns over time.

4. Focus on your own race rather than comparing yourself to other competitors

Taking part in a large event like the Festival of Endurance means competing alongside hundreds of fellow athletes. While this can create a real buzz of excitement and encouragement, it can also lead you to compare yourself to others who may be running faster than you or using different strategies to achieve their goal – which may also be entirely different from the target you are working towards yourself.

Focusing on what others are doing is likely to distract you from your own strategy. It could even sabotage your efforts and lead to you forgetting some of your own training. Instead, it’s best to concentrate on your race and doing the very best you can.

Investing is another task where focusing on your own strategy is vital. Everyone’s circumstances and goals are different, so your colleague, neighbour, or friend may be investing differently from you to achieve their goal. That’s why it’s crucial not to allow yourself to be swayed by what others are doing and stay focused on your own goals.

5. Work with a professional to help you achieve your full potential

Training for an endurance event often requires specialist help from a coach who can motivate you and guide you to achieve your full potential. Over time, this guidance means you’ll be able to achieve far more than you could have done on your own.

In financial matters, your financial planner is your coach. They won’t simply help you to understand which investments to make that could help you achieve your goals; they’ll also coach you through any big decisions you may need to make or the difficult emotions that can arise during times of market uncertainty.

Get in touch

If you’d like to learn more about how we can help you to build an investment portfolio that gives you the potential to achieve your financial goals, please get in touch. Email us at financial@barwells-wealth.co.uk or phone us on 01273 086 311 to speak to us today.

Please note

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

Production

Production