The last few years saw a dramatic rise in inflation, which you likely felt through higher prices on everything from your weekly shop to your energy bills.

While it has dropped significantly from its 40-year-high of 11.1% in 2022, inflation remained above the Bank of England’s (BoE) 2% target for nine months in 2024. And, according to the Office for National Statistics (ONS), it stood at 2.5% in December.

With inflation remaining stubbornly above target levels despite efforts to control it, the economy is experiencing what is sometimes called “sticky inflation”.

Read on to discover how sticky inflation could affect your finances and what you can do to ease its effects.

Interest rates could remain high to help ease inflation, but the Bank of England also wants to encourage economic growth

To help stem soaring inflation, the BoE gradually increased the base rate from 0.1% in December 2021 to a peak of 5.25% by August 2023. It then maintained this rate for a year before beginning to lower it in the summer of 2024.

At its most recent meeting, the BoE’s Monetary Policy Committee (MPC) voted to reduce the base rate from 4.75% to 4.5% in response to slow economic growth. While further cuts may follow in the coming months to boost the economy, any reductions are expected to be gradual as the BoE works to keep inflation in check.

Higher interest rates can significantly influence your finances, particularly when it comes to saving and borrowing. While inflation typically erodes the value of your cash savings, higher interest rates offer an opportunity for your savings to grow at more competitive rates. Indeed, the current base rate remains 2% above the latest inflation figures.

However, higher interest rates also increase borrowing costs, which could be a concern if you have a variable-rate loan or mortgage or are nearing the end of a fixed-rate term.

With inflation still above the target rate and economic growth remaining weak, the BoE faces the difficult task of needing to slow rising costs while supporting productivity.

Sticky inflation can drive up your expenses and reduce the purchasing power of your cash over time

Inflation causes your expenses to rise, and when it remains above the target level, it could erode your purchasing power if your wages don’t keep pace.

Although prices aren’t spiralling at the same rate they were in 2022, it’s important to remember that a “lower” inflation rate doesn’t mean prices are falling – only that they’re rising at a slower pace.

Your cash savings are also at risk, even when inflation is stable, as returns from many savings accounts often fail to keep up with rising costs. This reduces the purchasing power of your cash over time.

While the base rate is currently higher than inflation, this is not typically the case.

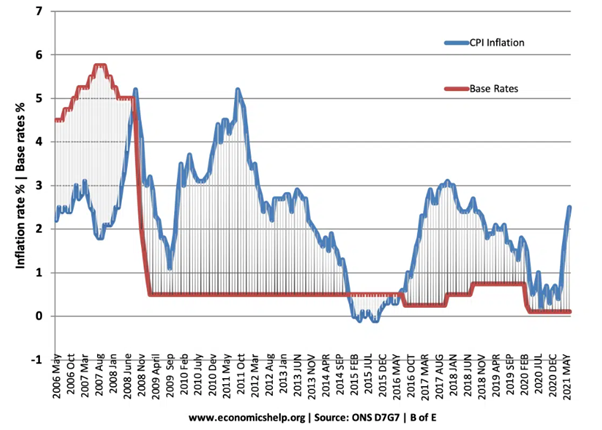

The graph below shows the UK inflation rate alongside the BoE base rate between May 2006 and May 2021, just as inflation was starting to climb and before the BoE began raising rates.

Source: Economics Help

As you can see, except for a brief dip between 2015 and 2016, inflation consistently outpaced the base rate from 2008 to 2021. This means that for much of this period, your cash savings would have likely struggled to keep up with inflation, as most banks and building societies use the base rate to guide the interest rates they set.

So, sticky inflation not only drives up prices but also erodes the real value of your cash over time, ultimately diminishing your purchasing power.

3 ways you can help protect your finances against sticky inflation

As you’ve seen, sticky inflation can present a challenge to your financial situation, but there are a few strategies you can adopt to help mitigate its effects.

1. Reassess your budget

As prices continue to rise, reassessing and adjusting your budget to reflect your current income and expenses can help you stay on top of your finances.

Regularly reviewing your spending can help ensure that sticky inflation doesn’t hinder your progress toward achieving your long-term financial goals.

While this may mean making certain adjustments in the short term, keeping your savings targets on track – regardless of the macroeconomic situation – will likely always be beneficial in the long run.

2. Invest in the stock market

Cash often struggles to keep pace with inflation, as you read earlier. So, although it’s a good idea to keep some savings in cash for short-term needs, investing a portion of your wealth in the market could help preserve its purchasing power over time.

Research by Schroders revealed that cash typically has only a 60% chance of outpacing inflation over various time horizons. Meanwhile, the likelihood of the market beating inflation has historically improved over time, reaching a 100% success rate over 20 years.

While market fluctuations can occur in the short term, long-term investments have the potential to deliver returns that exceed average inflation, helping to protect and grow your wealth for the future.

3. Diversify your portfolio

If sticky inflation is driving up your daily expenses, a well-diversified portfolio can help offset the effects.

By spreading your investments across different asset classes, you can balance rising costs with potential appreciations in other areas.

Get in touch

Our team of independent financial advisers in Lewes is here to help you protect your finances against sticky inflation and ensure you remain on track to achieve your long-term goals.

To find out more, please get in touch by emailing us at financial@barwells-wealth.co.uk or calling on 01273 086 311.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

All information is correct at the time of writing and is subject to change in the future.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Production

Production