The idea that money can grow on its own over time may seem like wishful thinking, but over long time horizons, that’s exactly what compounding enables.

Compounding is the process of earning returns on previous returns as well as on your investment. Over time, this cycle can create exponential growth that may eventually lead you to the “compound investment tipping point” – the point at which your returns exceed your total contributions.

With the potential for your investments to generate more than their value, you can see why compounding is sometimes referred to as the eighth wonder of the world.

Read on to find out about compounding and how you can reach the tipping point.

Compounding helps your investments grow over time

Whether you’re saving or investing, any positive returns on your initial investment can grow further through the power of compounding.

For example, imagine you set aside a lump sum of £10,000 and it earned a consistent annual return of 5%. After one year, you’d have £10,500. In the second year, you would get a 5% return on both the initial £10,000 and the additional £500, bringing your balance to £11,025.

Each year, your returns are not just based on your original £10,000 but also on the returns you’ve previously accumulated. Over the long term, this effect snowballs – or “compounds”.

With a 5% annual return on £10,000, your investment could double in about 14 years. By that point, your total returns would surpass your initial investment and would have reached the “tipping point”.

Smaller investments can also benefit from compounding

Compounding doesn’t just work with lump sums (as in the above example), and smaller, regular contributions can also lead to significant growth.

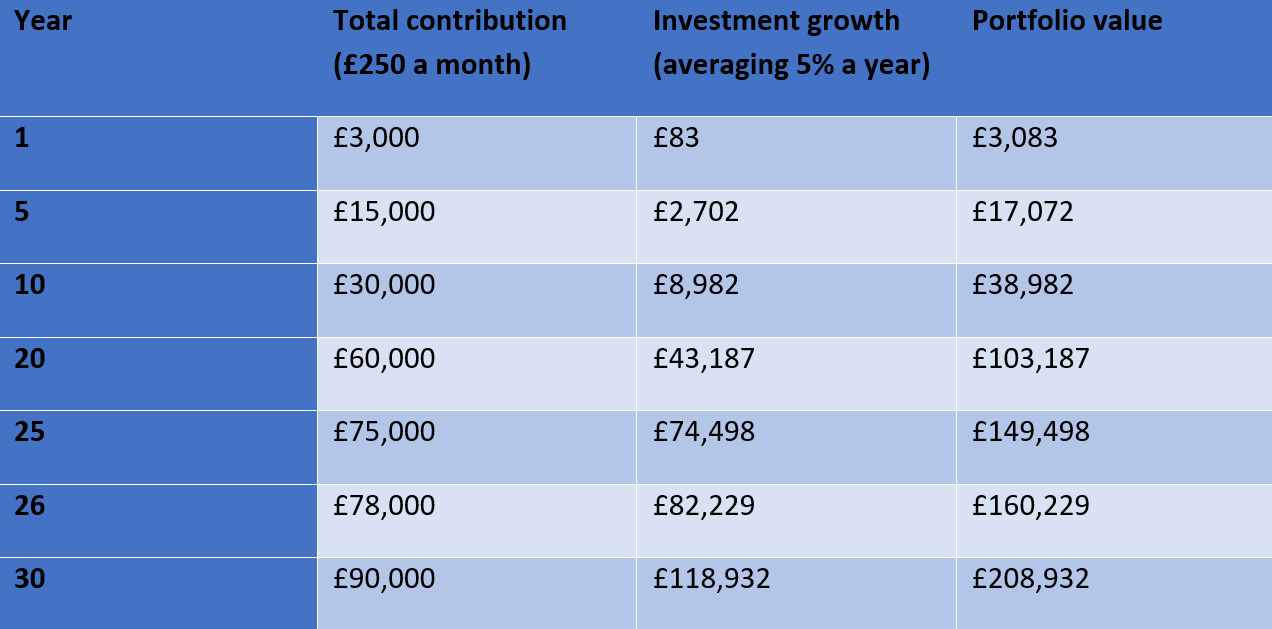

Let’s say you invest £250 a month and earn an average annual return of 5%. In the first year, your £3,000 in contributions would generate just £83 in returns, less than 3% of your total pot.

Yet, fast forward 10 years, and your total contributions of £30,000 would have grown by £8,982, meaning nearly a quarter of your pot would be made up of investment gains.

By year 25, you’d have contributed £75,000, and your returns – now worth £74,498 – would be approaching the value of your total contributions.

Then, in year 26, with £78,000 invested, your returns would surpass £82,000, meaning you would have officially crossed the point where your returns outweigh the money you’ve invested.

The table below shows the effects of compounding in this example.

Source: Nutmeg

5 steps that could help you reach the compound investment tipping point

While no strategy can guarantee investment returns or ensure you’ll hit the compound investment tipping point, there are several ways to improve your odds.

1. Know your risk profile

Every investment carries risk, and how much you take on should reflect your goals and time horizon. For longer-term objectives (such as reaching the compound investment tipping point), you might take on more risk in the early stages, giving your portfolio time to recover from short-term dips.

Your risk tolerance isn’t static, so it’s a good idea to review it regularly. A financial planner can help you assess your current profile and make adjustments as your life and goals evolve.

2. Diversify your investments

Spreading your investments across sectors, regions, and asset classes can help to reduce the impact of any single underperforming asset. It also increases your exposure to a broader range of return opportunities, both of which can help you on your path to long-term, steady growth.

3. Keep an eye on costs and fees

High trading activity and fund fees can erode your returns over time. Holding investments over the long term and leaving them can help allow compounding to do its work without frequent adjustments.

4. Set goals and stick to your plan

Start with a clear picture of what you’re working toward and how long you have to get there. A well-defined strategy grounded in your personal goals can help you stay the course, especially when markets become volatile.

5. Work with a financial planner

A financial planner can help tie all these elements together into a cohesive, personalised investment plan. With the right strategy and support, you may find your investments eventually generating more wealth than you contributed.

Our team of independent financial advisers in Lewes is here to support you in reaching the compound investment tipping point.

To find out more, please get in touch by emailing us at financial@barwells-wealth.co.uk or by phone on 01273 086 311.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

All information is correct at the time of writing and is subject to change in the future.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Production

Production