At the end of January, the Chinese AI company DeepSeek launched its eponymous large language model, sending the markets into a frenzy.

The company was seemingly able to produce similar outputs to ChatGPT and other chatbots but at a fraction of the cost and using far less powerful chips.

Investor’s Business Daily reports that DeepSeek’s arrival wiped nearly $1 trillion off the S&P 500 in a single day, with Nvidia alone losing nearly $600 billion in value. By the end of February, the market had stabilised and Nvidia had recovered most of its losses, though both have since dipped again for other reasons.

These events speak to the value of two key principles of an evidence-based approach to investing:

- Portfolio diversification

- Long-term focus

Read on to discover what the arrival of DeepSeek can teach you about the importance of these principles and why they are the foundation of an evidence-based approach.

Portfolio diversification can help protect against market dips and open you up to wider gains

Portfolio diversification entails spreading your investments across different asset classes, regions, and sectors. This approach reduces reliance on any single market, helping to cushion your portfolio against downturns.

However, diversification isn’t just about risk management – it also broadens your exposure to opportunities in various markets, increasing your chances of capturing potential gains you might otherwise miss.

For example, if you had been heavily invested in US stocks in January, you would have likely felt the downturn more than those with a balanced portfolio spread across several regions.

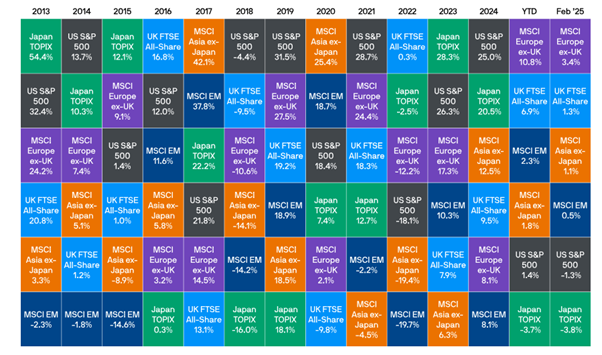

The table below shows the ranked performance of major global indices between 2013 and February 2025.

Source: JP Morgan

As you can see, the S&P 500 was the second-worst performer in February and in the year-to-date. However, it has been the top-performing index in 4 of the 12 years (inclusive) between 2013 and 2024.

Predicting which indices will be successful from one year to the next is near impossible. For instance, the MSCI Asia ex-Japan was the best performer in 2020 and the worst in 2021.

So, rather than concentrating your investments into one region or market, diversification reduces your exposure to risk while also opening you up to wider growth opportunities.

The same principle applies to asset classes and sectors.

For instance, the table below shows the ranked performance of different asset classes over the same period.

Source: JP Morgan

The data shows that growth assets have been the strongest performers for the past two years, but in 2022 and in the year-to-date they have been the weakest.

Markets can be unpredictable, and over-reliance on any one area leaves you vulnerable to downturns. By diversifying across multiple sectors, asset classes, and regions, you can reduce risk, limit volatility, and position yourself to capture growth opportunities across different markets.

Markets typically trend towards growth in the long term despite short-term dips along the way

The dip in January was considerable, and it’s not unusual for significant events to precipitate downturns.

During such periods, you may be tempted to exit the market to limit your losses. However, markets have historically been resilient and are often quick to recover.

Data from the S&P Global shows that the S&P 500 had recovered from January’s dip by mid-February. Even after some of the sharpest declines of the last century, markets have eventually rebounded.

The graph below shows the growth of $1 on the MSCI World Index from 1970 to 2019 alongside the timeline of significant world events that have caused dips.

Source: Harvest

As you can see, even though events such as the subprime mortgage crisis, 9/11, and the Arab oil embargo caused considerable dips in the global market, it continues to trend upward over the long term.

Indeed, exiting the market often means you miss the chance to recover quickly after significant downturns.

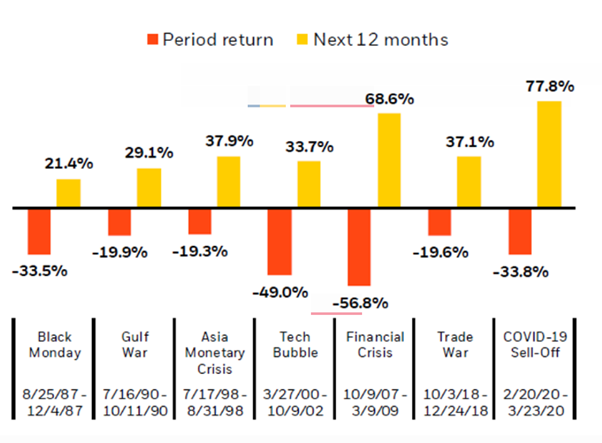

The graph below shows how average returns on the S&P 500 dropped into negative territory during several global crises since 1987, only to be followed by strong rebounds over the subsequent 12 months.

Source: Forbes

If, for example, you chose to exit at the onset of the pandemic in 2020 as returns fell by more than 30%, you would have missed out on the potential to recover your losses the following year and make gains of 44%.

So, while selling during a market dip may seem like a quick way to limit losses, staying focused on long-term trends rather than short-term fluctuations can improve your chances of recovering and maximising gains.

Get in touch

Our team of independent financial advisers in Lewes can work with you to build a diversified portfolio based on your long-term goals, giving you the confidence and stability to weather short-term fluctuations.

To find out more, please get in touch by emailing us at financial@barwells-wealth.co.uk or by phone on 01273 086 311.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Production

Production