In common with many other team sports, such as football and rugby, cricket hosts a World Cup every four years.

While they may have underperformed in India this time around, England was successful at the last World Cup tournament held on home turf in 2019, winning the trophy for the first time.

As keen cricket fans ourselves and sponsors of Balcombe Cricket Club, we have often been struck by the parallels that can be observed between the sport and lifestyle financial planning.

So, read about some lessons you can learn from the Cricket World Cup, and how some of them could offer some clues as to why England failed this time around.

1. All-round strength is often better than individual performances

A look back through recent Cricket World Cup history will confirm to you that successful teams are the ones with the best-balanced side, rather than those with just one or two top performers.

In 2015, Steve Smith and Michael Clarke were the standout performers with the bat as Australia beat New Zealand in the final. Then four years later Ben Stokes rightly gained plaudits for his extraordinary batting in the final at Lords.

But all of them benefited from strong bowling performances that made their job easier.

Each of the players in a cricket team has their own specialism – batting, bowling, keeping wicket, and so on – and the correct mix can go a long way to achieving on-field success.

In the same way, your investment portfolio will require a balance of asset types depending on the goals you are working towards.

You should try to maintain a mix of investments and avoid relying too much on one or two individual shares or funds when it comes to building an investment portfolio.

Values of asset classes fall and rise at different times so, by diversifying your investments, you can potentially benefit from the opportunity for consistent growth rather than being exposed to the fluctuation in a single market.

2. It’s essential to plan ahead

One of the criticisms of the England team after their woeful performance at this World Cup is that they have been reactive to events as they occur rather than having well-established plans to cope with issues before they arise.

The selection process appeared to be confused and the team only played a limited number of games as a unit against strong opposition in the run-up to the event.

Likewise, having a coherent and robust plan in place is a key part of securing your financial future. From setting out your long-term goals and establishing what you need to do to meet them, to regular reviews to check you’re on track, having a clear plan forms the basis of our approach.

You also need to be ready for potential changes in your personal and financial circumstances so you can adapt your plans accordingly.

3. Don’t get tangled up in jargon

As a sport, cricket is notorious for some of the jargon used when describing it. Expressions such as “googly”, “silly point”, and “five-for” have long been part-and-parcel of the game. Cricket fans tend to revel in it, but a lot of the terms used can bewilder the occasional viewer.

Similarly, when it comes to planning your financial future, there is a lot to think about and a lot of confusing specialist terms to get your head around.

By working with a financial planner who can talk you through the terms you need to know, and how they apply to your plan, you can avoid feeling lost or confused about what it all means.

4. It pays to keep a level head

A cricket match played in front of thousands of passionate supporters, and with millions watching on TV, can often be decided by the way players respond to the pressure such an audience can bring.

Many cricketers have found it hard to stay emotionally detached and focus on what needs doing. In contrast, a batter like Virat Kohli has proved himself one of the greatest high-pressure performers thanks to his ability to tune out everything except the task at hand whenever he walks out to bat.

In the same way, keeping a level head and refusing to panic can benefit you when it comes to managing your financial future – especially where your portfolio is concerned.

It’s easy for emotion to affect your investment decision-making, particularly at times of stock market volatility.

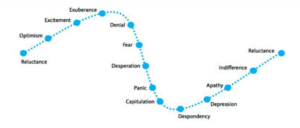

The diagram below shows a typical cycle of investor emotions, and probable responses to the rise and fall of investment values.

Source: Barclays

By staying calm, and appreciating that investing is a long-term commitment, you can avoid overreacting to short-term adverse performance. In doing so, you reduce the risk of making bad judgment calls that could hinder your progress towards your goals.

5. Remember it’s a team game

While individuals such as Glenn Maxwell, Daryl Mitchell, and Shaheen Afridi can produce winning individual performances, they would be the first to tell you that it’s the performance of the overall team that will bring long-term success.

Furthermore, a team is often comprised of more than just those who happen to be on the field at any one time.

For one thing, there will be other players in the squad whose performances may be a critical factor in ultimate success. Then there are the back-room staff – coaches, physios, doctors, and team administrators – who will all play a valuable role in any successful team.

In the same way, when it comes to your personal finances, you will be able to draw strength from an environment where everyone is pulling in the same direction.

Working with a financial planner means you have a great team working with you to achieve success – whatever that looks like to you.

Get in touch

If you’d like to find out more about how we can help you make the right decisions when it comes to planning your financial future, please get in touch.

Email us at financial@barwells-wealth.co.uk or call 01273 086 311.

Please note

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future results.

The tax implications of pension withdrawals will be based on your individual circumstances. Thresholds, percentage rates and tax legislation may change in subsequent Finance Acts.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

This article is for information only. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

Production

Production